Security and speed for banks and fintechs

Accelerate mobile releases without compromising on security and compliance.

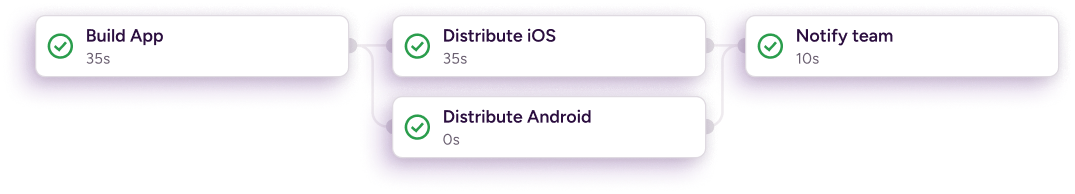

One-stop-shop for everything mobile

Get mobile CI/CD, remote caching, managed build environments, and release management all from one powerful platform.

Speed up your

build-and-release

cycles by

75%

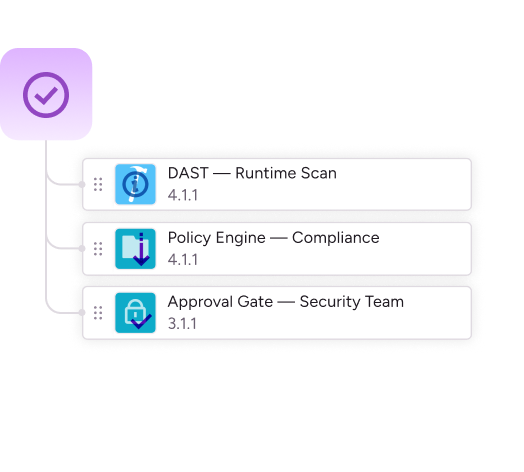

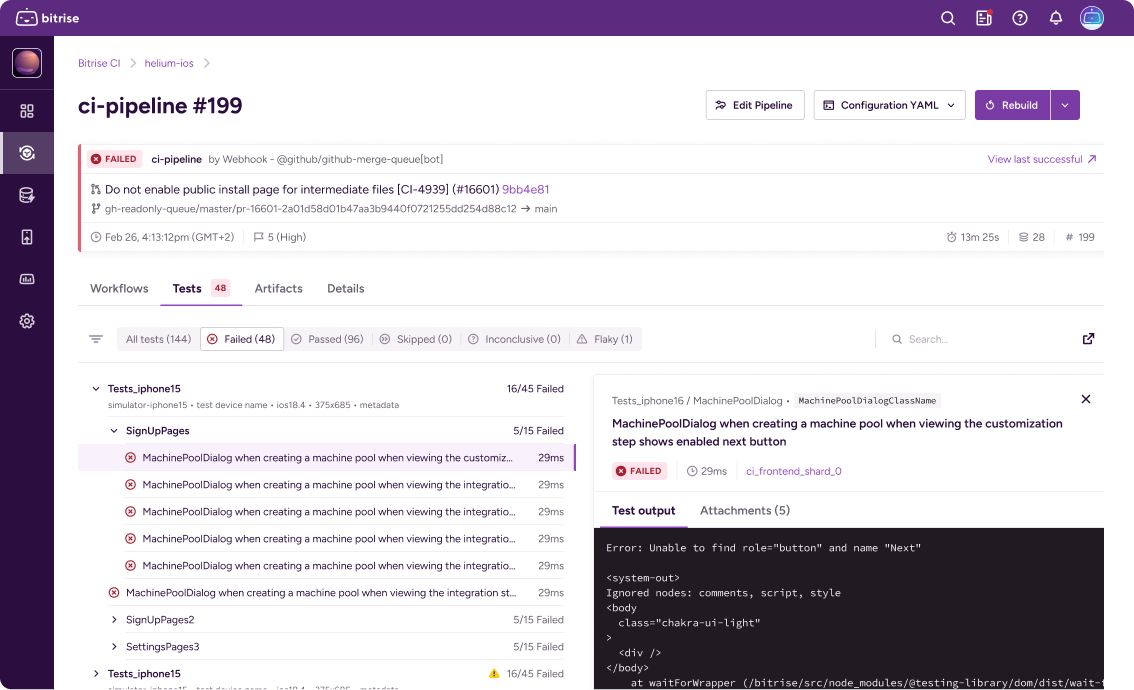

Automate essential checks

Add all necessary security, compliance, and quality assurance steps to your workflows with one click.

Protect your customers’ data

Private build environments mean speed, availability, and extra security for sensitive financial information.

3X

Faster time to market

Ship with confidence

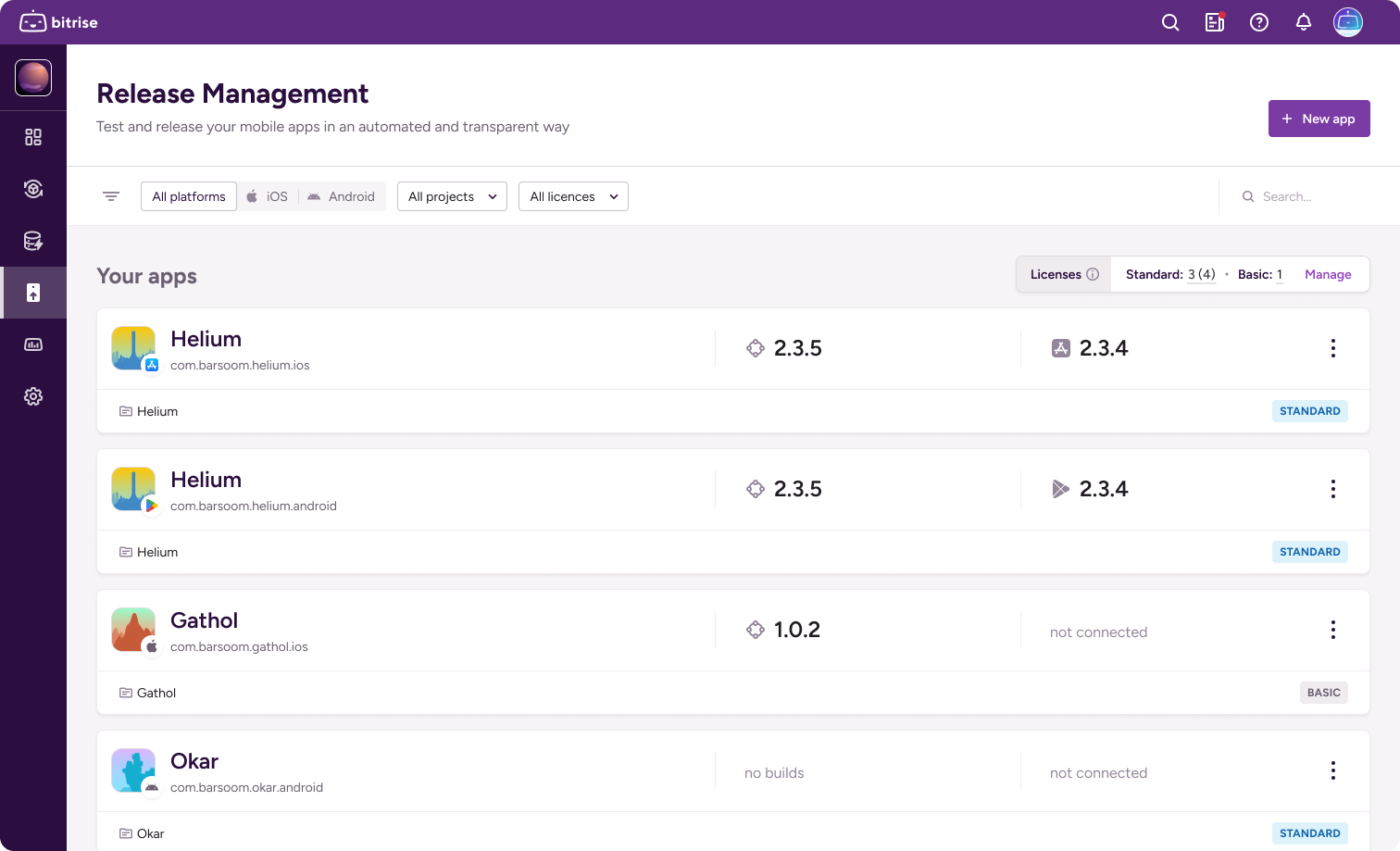

Maintain a high level of control over new releases with secure test distribution, phased rollouts, and quick rollback capabilities.

Book a free consultation

Running multiple apps? Grappling with complex security requirements?

Spend some time with one of our mobile DevOps experts to discover how you can streamline your mobile development process.

Why banks and fintechs choose Bitrise

Prioritize security

Bitrise offers SOC 2 compliance, automated code signing, granular access controls, and essential security tests integrated directly into your workflows.

Learn more about security

EU and US data residency

Choose EU-only, US-only, or global builds. Whether you’re navigating internal or regional compliance requirements, host your code and build execution in full compliance with EU and US data protection standards.

Compliance-ready CI/CD

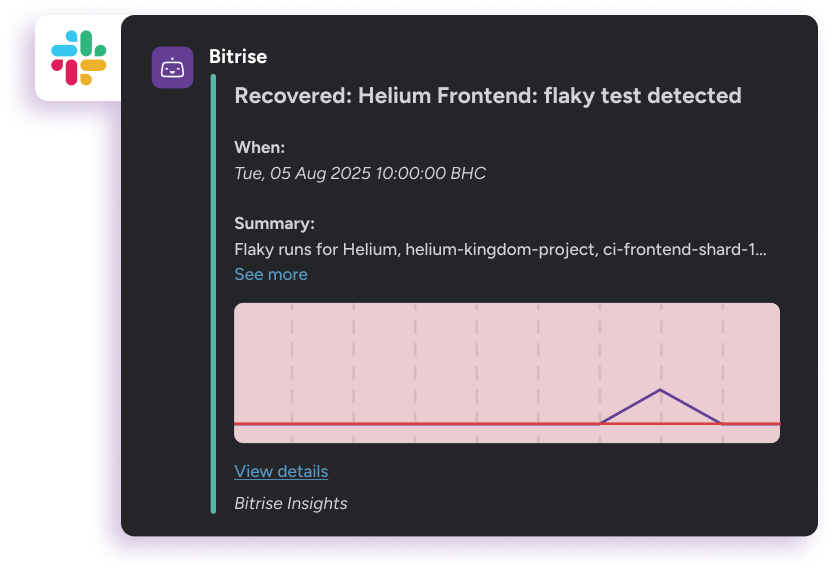

Automate regulatory checks and security tests, so you can accelerate release recycles without sacrificing compliance or governance.

Integrate seamlessly

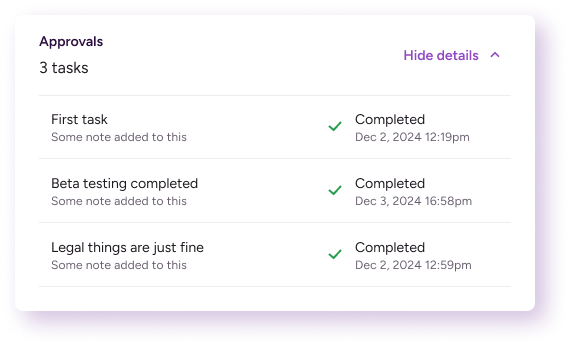

Connect directly with your SAST/DAST scanners, security and compliance frameworks, and internal approval processes to create a unified pipeline.

Book a demo

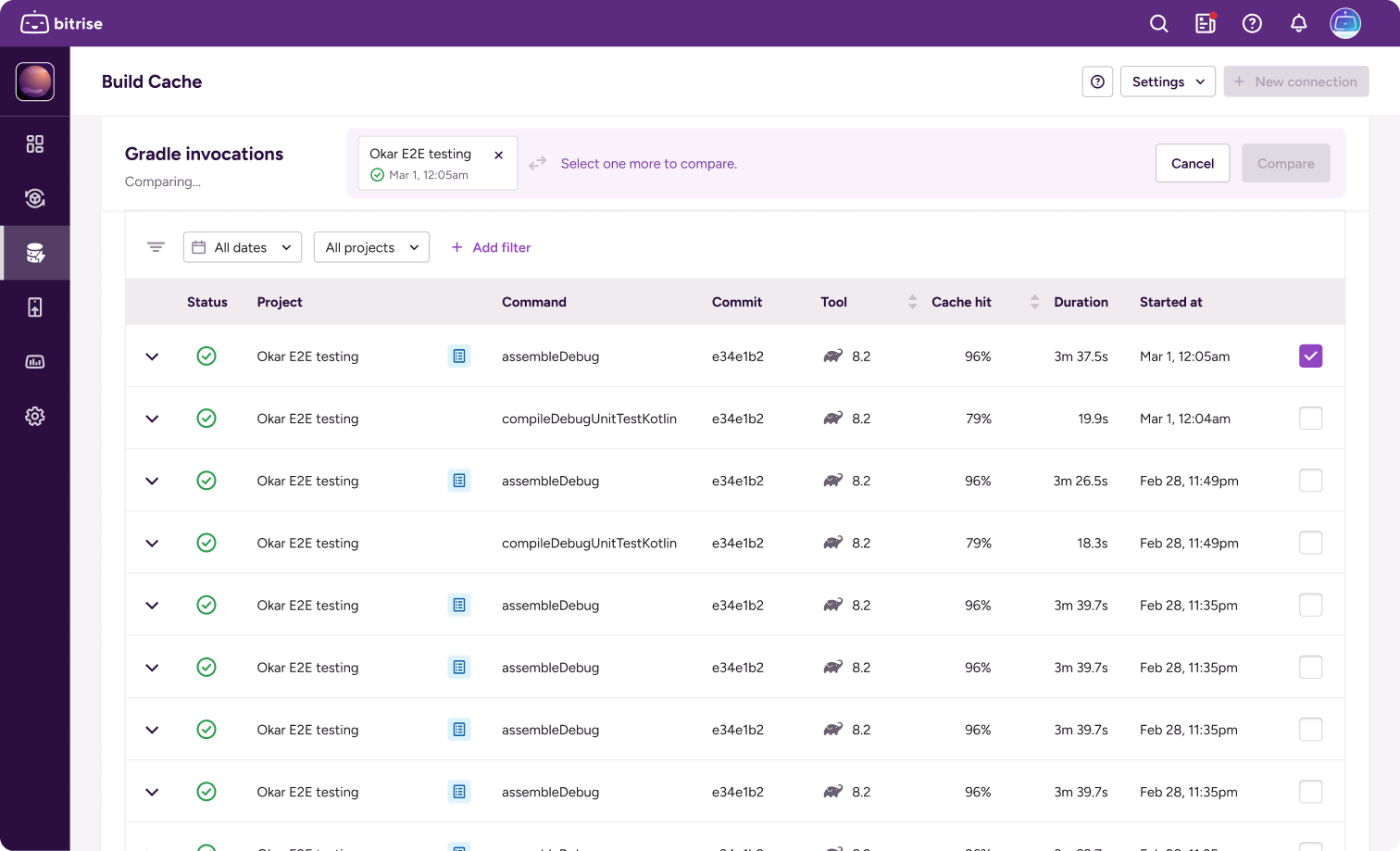

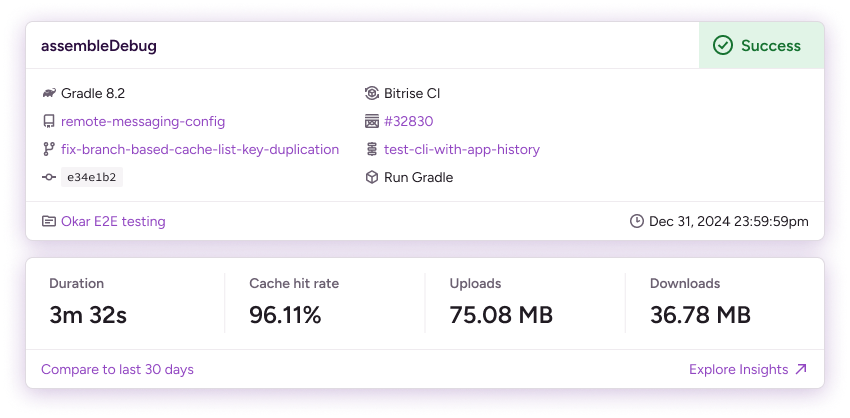

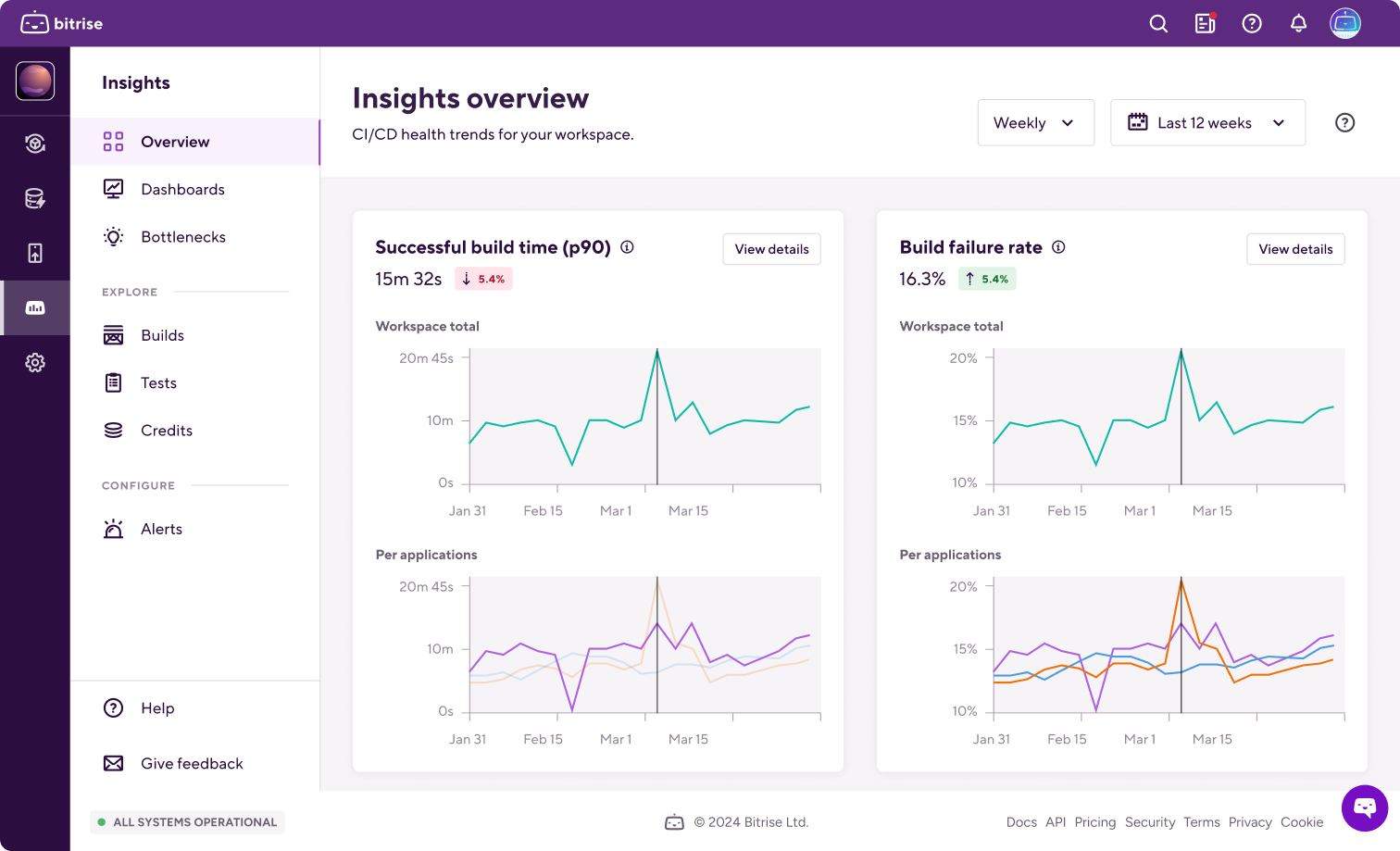

Maximize visibility

Monitor every aspect of your mobile app builds with detailed analytics and audit logs—critical for governance and regulatory compliance.

Meet your mobile banking CI/CD platform

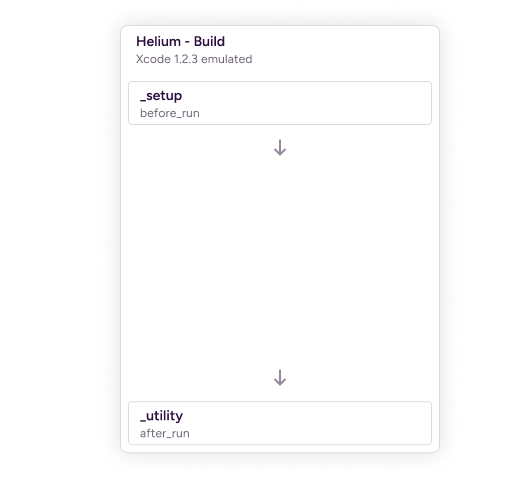

Mobile builds with no messy migrations

Our plug-and-play infrastructure for Github Actions, point mobile builds to Build Hub while keeping GitHub Actions as your CI orchestrator. No costly migrations, just connect, point, and run.

Find out more

Top security features for fintechs and banks

Automated security testing

Integrate SAST, DAST, and dependency scanning.

Secure credential management

Protect API keys and certificates.

Compliance validation

Automate GDPR, PCI-DSS, and other regulatory checks.

Audit logging

Comprehensive records for all build and deployment activities.

Role-based access control

Fine-grained permissions for team members.

Secure infrastructure

SOC 2 certified platform with private cloud options.

Flexible pricing and deployment options

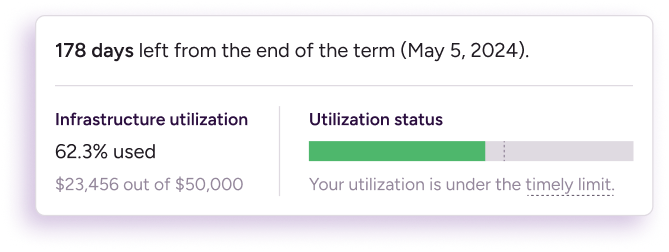

Take full control of how you build with our Enterprise plan.

- Zero-margin infrastructure: you only pay for what you use

- Unlock more value with volume and utilization discounts

- Access to our fastest build machines and enterprise-grade features

- Your own customer success manager for 1:1 support

Public Build Platform

Your builds run on isolated, purpose-built VMs in our public cloud infrastructure.

Dedicated Build Platform

Physical Bitrise machines running your VMs are dedicated to you for the duration of your build.

Private Build Platform

Exclusive hardware from Bitrise with no shared resources and 24/7 premium support.

Bitrise on AWS

Provision machine instances via EC2 on AWS, run Bitrise workflows on your AWS machines.

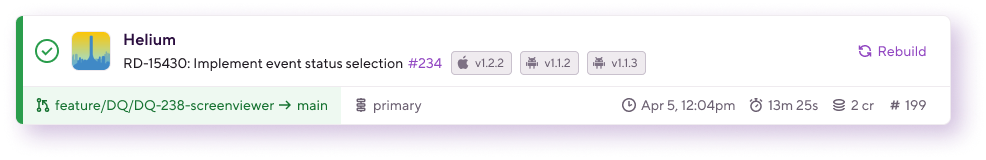

Banking and fintech success stories

A UK-based payments provider whose app now has a 4.5-star rating thanks to Bitrise.

Uses Bitrise to build some of Australia’s fastest growing fintech apps with zero downtime.

This BNPL provider reduced build times from over an hour to ~15 minutes and achieved a 90% build success rate.

Insurance giant Generali cut build times by 20% and released their flagship app ahead of schedule.

Challenger bank N26 decreased testing time by 80% and build times by 50%, tripling their release frequency as a result.

Book your consultation

Enter your details and we’ll be in touch to schedule your session with a Bitrise expert.

Frequently Asked Questions

Can Bitrise help our financial institution accelerate mobile app delivery while maintaining security?

Definitely. Bitrise combines mobile-specific DevOps automation with enterprise-grade security features to help banks and financial institutions speed up build-and-release cycles by up to 75%. Our SOC 2 compliant platform includes automated security testing, secure code signing, and private build environments that are ideal for mobile apps that handle sensitive financial data.

Is Bitrise suitable for banks with strict regulatory compliance requirements?

Absolutely! Bitrise is built with compliance at its core, offering automated compliance checks for GDPR, PCI-DSS, and other regulatory requirements. Our comprehensive audit trails, role-based access controls, and automated security testing (including OWASP Mobile Top 10 checks) ensure your banking app meets stringent regulatory requirements without compromising on speed and innovation.

Can Bitrise integrate with our existing financial security stack and compliance workflows?

Yes! Bitrise connects seamlessly with your existing security testing frameworks, SAST/DAST scanners, and internal approval processes. With 400+ integrations available, you can create a unified pipeline that works with your current fintech infrastructure while maintaining security and compliance standards.

How quickly can fintechs implement Bitrise for mobile banking apps?

Most customers deploy their first automated build within hours and have complete CI/CD pipelines running within a day. Migration from your existing CI/CD solution is also straightforward, so it’s perfect for fintechs that need to move fast with minimal disruption to their build-and-release cycles.

Do I need to migrate from my current CI to use Bitrise?

No, Bitrise Build Hub works with your existing CI and workflows. You keep your CI orchestrator and upgrade your build execution infrastructure provided by Bitrise. No complex platform migration, no workflow rewrites, and most teams see results within days. For now, this is only possible with Github Actions, however, our goal is to future-proof our solution and become provider-agnostic for any team that needs best-in-class build infrastructure. We’re planning to roll out support for other CI platforms in the second half of 2026. If you need support sooner, don’t hesitate to get in touch.

What makes Bitrise different from other CI/CD platforms for banks and financial institutions?

Unlike general-purpose tools, Bitrise is designed specifically for mobile apps with a high emphasis on security. We offer specialized features like preconfigured mobile build environments, automatic code signing, verified mobile Steps, secure beta distribution, and automated compliance documentation for app store submissions—all designed to enhance security while eliminating friction and DevOps maintenance burdens.

How does Bitrise help fintechs balance speed with security requirements?

Bitrise automates essential security, compliance, and quality assurance checks within your workflows, allowing you to accelerate release cycles without compromising protection. Our private build environments provide speed and availability while adding an extra layer of security around sensitive financial information.

Can Bitrise handle the scale of enterprise banking applications?

Absolutely! International digital bank N26 serves 7 million customers across 24 markets, and uses Bitrise to power their complex mobile banking ecosystem.

Does Bitrise support both iOS and Android development for banking apps?

Yes! Bitrise is designed to unify complex mobile ecosystems on one platform, supporting both iOS and Android development with shared workflows and consistent practices. Our mobile-specific testing framework ensures your banking app functions perfectly across all devices while maintaining security standards.